Half-year results 2023

- Order backlog is at a record high at €14.1 billion, up 11% at constant exchange rates, excluding main acquisitions and disposals

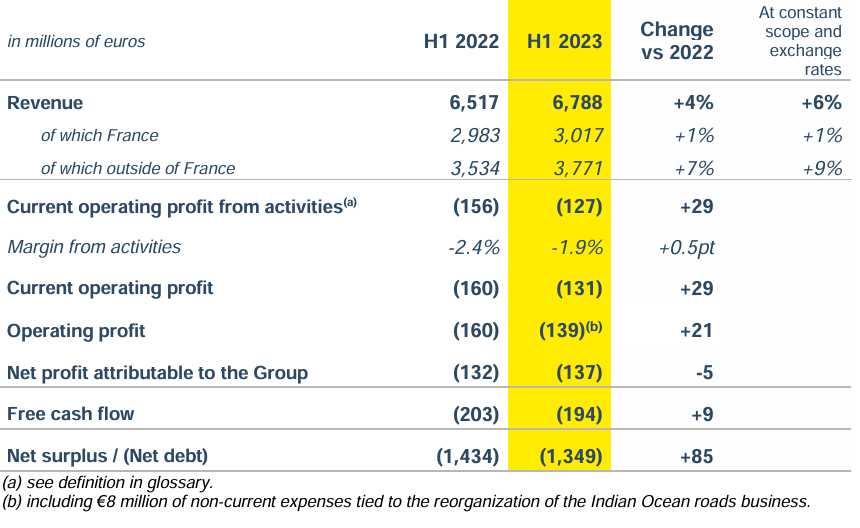

- Revenue totals €6.8 billion, up 4% from H1 2022 (+6% at constant scope and exchange rates)

Reminder: due to the highly seasonal nature of the majority of the Group's businesses, operating losses are recorded every first half-year.

- Current operating profit from activities is at -€127 million, a €29-million improvement on H1 2022

- Net profit attributable to the Group amounts to -€137 million, down €5 million compared to H1 2022

- Free cash flow totals -€194 million, a €9-million improvement on H1 2022

- Net debt is at €1.3 billion, down €85 million compared to end-June 2022

The Board of Directors of Colas, chaired by Frédéric Gardès, met on July 25, 2023 to approve the financial statements as at June 30, 2023 and the outlook for the current year.

Consolidated key figures

Order backlog

At the end of June 2023, the order backlog stood at an all-time high of €14.1 billion, up 9% year-on-year and 11% at constant exchange rates and excluding major acquisitions and disposals.

In Mainland France, the order backlog amounts to €3.6 billion, up 6% year-on-year, driven in particular by the Railways business.

For the International and French Overseas units, order backlog totals €10.5 billion, up 10% year-on year (+14% at constant exchange rates and excluding major acquisitions and disposals).

This increase is attributable to:

- Colas Rail, notably with the Abidjan metro in Côte d'Ivoire, contracts signed as part of the South Rail Systems Alliance program in Great Britain, and new maintenance contracts in Northern Europe,

- a healthy order backlog in North America, with major repaving contracts in the United States and road maintenance contracts in Canada.

Business units in International and Overseas France account for 75% of Colas' total order backlog, compared with 74% at the end of June 2022.

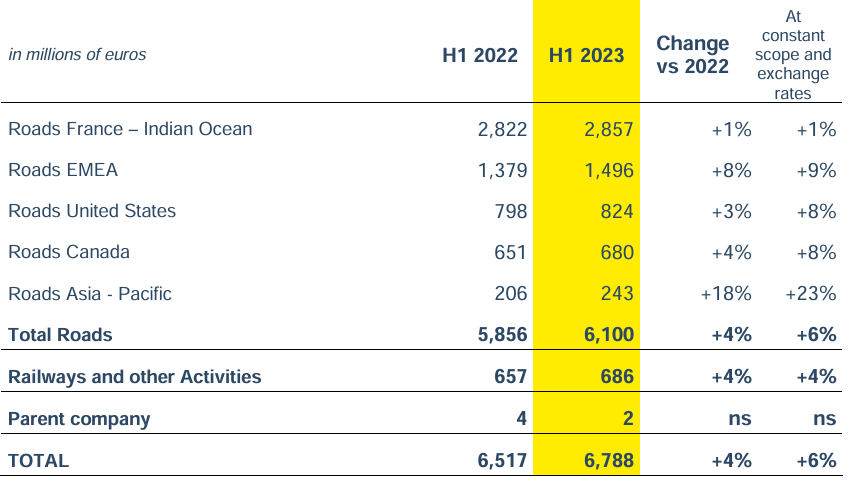

Revenue

Consolidated revenue for the first half of 2023 stands at €6.8 billion, up 4% compared to the first half of 2022 (+6% at constant scope and exchange rates). A breakdown of H1 2023 revenue shows €3.0 billion in France and €3.8 billion for the international units (respectively +1% and +9% at constant scope and exchange rates).

Roads:

Revenue for the first half of 2023 amounts to €6.1 billion, up 6% at constant scope and exchange rates compared with the first half of 2022.

- In the France-Indian Ocean zone, revenue is up 1% on H1 2022.

- In EMEA (Europe, Middle East, Africa), revenue is up 9% at constant scope and exchange rates, driven by a good level of activity in Europe.

- In the United States and Canada, revenue is up 8% at constant scope and exchange rates, boosted by a dynamic market.

- In the Asia-Pacific zone, revenue is up 23% at constant scope and exchange rates, mainly thanks to a good level of activity in Australia.

Railways and other Activities:

Revenue for Railways and other Activities was up 4% year-on-year at constant scope and exchange rates, driven mainly by Colas Rail's strong momentum outside of France.

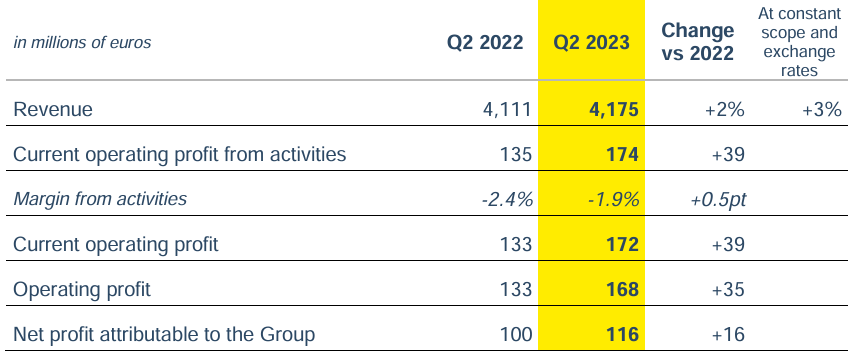

Financial Performance

Current Operating Profit from Activities (COPA) amounts to -€127 million in the first half of 2023, an improvement of €29 million from the first half of 2022. Q2 COPA was up €39 million from Q2 2022, at €174 million. This improvement is due in particular to the beneficial impact of action plans implemented during 2022 to cope with inflation, whereas results for the first half of 2022 were impacted by higher production costs not passed on to business entered in the order backlog earlier on. As a result, margins from activities improved by 0.5 point compared with the first half of 2022.

The share of net income from joint ventures and associates totals €33 million, up €11 million from the first half of 2002. This improvement was driven by the contribution of Tipco Asphalt, which benefited from favorable business conditions in its domestic market in Thailand.

Net profit attributable to the Group stands at -€137 million, compared with -€132 million at the end of June 2022. This change reflects in particular the inclusion in H1 2023 of €8 million in non-current expenses tied to the reorganization of the Indian Ocean roads business, alongside higher financial expenses due to increased interest rates.

Net Debt

Free cash flow is at -€194 million compared to -€203 million in the first half of 2022. Free cash flow for Q2 2023 was €131 million, an increase of €27 million compared to the same period of the previous year.

Free cash flow after changes in working capital requirements from activities amounts to -€766 million, an improvement of €318 million compared to the end of June 2022. This change is due to a lower increase in working capital requirements of €309 million at the end of June 2023 compared to the end of June 2022 as a result of trade receivables and inventories.

Net debt at June 30, 2023 is €1.3 billion, compared to €0.3 billion at the end of December 2022, reflecting a seasonal pattern typical for Colas’ businesses. Nonetheless, it decreased by €85 million compared to the end of June 2022.

CSR Commitments

Colas has launched Flowell interactive illuminated crosswalks on the market, after obtaining approval from the French Ministry of Transport. This innovative device improves user safety in public spaces, day and night.

From June 12 to 16, Colas celebrated the 10th edition of Safety Week, a week-long event dedicated to mobilizing its 58,000 employees worldwide around health and safety issues. The focus was on the risk of machine-pedestrian collisions, identified as the main factor behind serious accidents in recent years.

On June 5, Colas organized an Environment Day for all its locations worldwide. This third edition was devoted to the preservation of water resources.

In addition, Colas continues to raise employee awareness of climate issues through a workshop called "Climate Fresk”, which had registered over 12,500 participants by the end of June 2023. Colas has also created a second workshop, "The Low Carbon Way Fresk", dedicated to the impacts of its activities on the climate.

Outlook

In an unstable environment marked by inflation, rising interest rates and currency volatility, the Colas Group has solid fundamentals and will continue to benefit from the positive impact of the transformation projects it has undertaken.

Colas confirms its target of increasing current operating profit from activities (COPA) and current operating profit in 2023 compared with 2022.

Condensed consolidated income statement for Q2 2023

Revenue at June 30, 2023 by business segment

The financial statements are available at www.colas.com.

The half-year financial report is available at www.colas.com.

The financial statements were subject to a limited review by the Statutory Auditors, who have published a report thereof.

Glossary

Order backlog: the amount of work still to be done on projects for which a firm order has been taken, i.e. the contract has been signed and has taken effect (after notice to proceed has been issued and suspensory clauses have been lifted).

Changes in revenue at constant scope and exchange rates:

- at constant exchange rates: change after translating foreign-currency sales for the current period at the exchange rates for the comparative period;

- at constant scope: change in revenue for the periods compared, adjusted as follows:

- for acquisitions, by deducting from the current period those sales of the acquired entity that have no equivalent during the comparative period;

- for divestments, by deducting from the comparative period those sales of the divested entity that have no equivalent during the current period.

Current operating profit from activities (COPA): current operating profit before amortization of intangible assets recognized from acquisitions.

Free Cash Flow: net cash flow (determined after (i) cost of net debt, (ii) interest expense on lease obligations and (iii) income taxes paid), minus net capital expenditure and repayments of lease obligations. It is calculated before changes in WCR (working capital requirement).

Net surplus cash/(Net debt): the aggregate of cash and cash equivalents, overdrafts and short-term bank borrowings, non-current and current debt, and financial instruments. Net surplus cash/(Net debt) does not include non-current and current lease obligations. A positive figure represents net surplus cash and a negative figure represents net debt.

Discover Colas’ latest press releases

Colas strengthens its operations in France with the acquisition of the Burgundy-based Hubert Rougeot Meursault Group

Appointment Stéphanie Minnebois, Group VP Techniques, Research, Development and Innovation, joins Colas' Executive Committee