Results at end-September 2022

- Order backlog is very high at €12.4 billion, up 30% year-on-year (+19% at constant exchange rates and excluding major acquisitions and disposals)

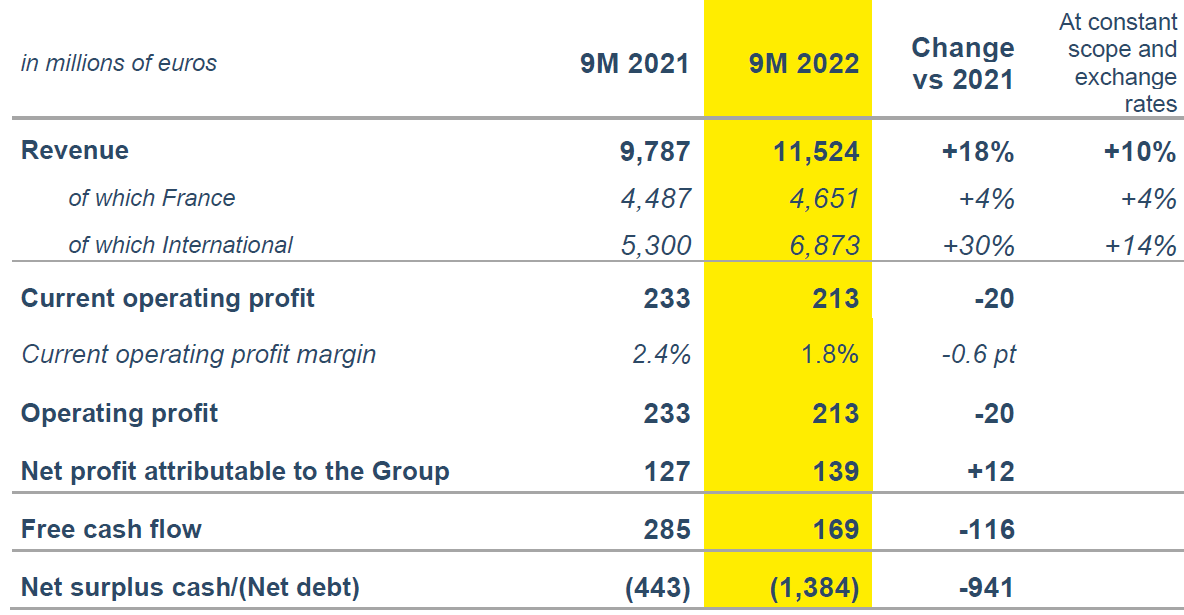

- Revenue totals €11.5 billion at September 30, 2022, up 18% year-on-year (+10% at constant scope and exchange rates)

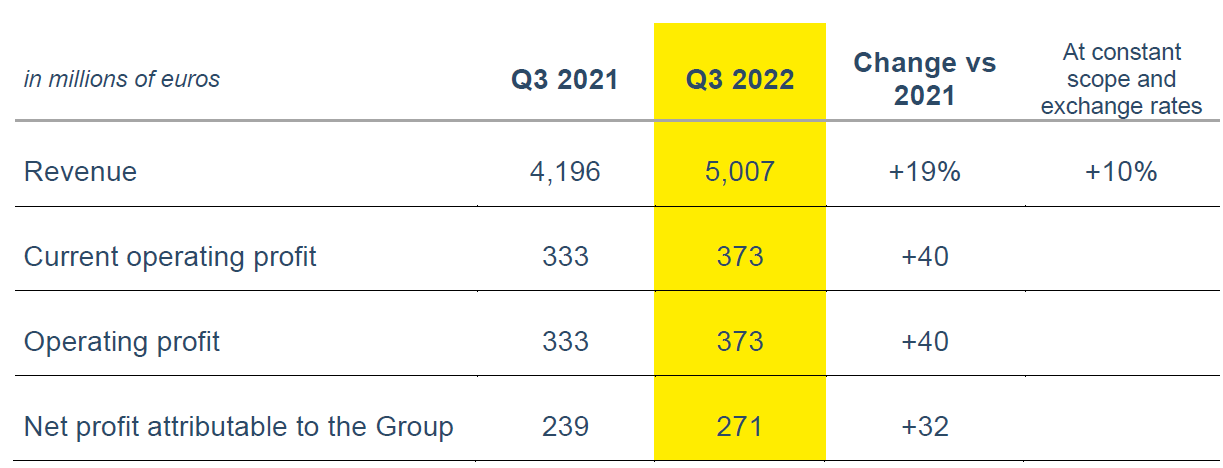

- Current operating profit at €213 million, down a slight €20 million year-on-year, after a Q3 increase of €40 million compared to Q3 2021

- Net profit attributable to the Group at €139 million, a €12-million-improvement compared to end-September 2021

- Free cash flow at €169 million, down €116 million compared to end-September 2021

- Net debt at €1.4 billion, up €0.9 billion compared to end-September 2021

The Board of Directors of Colas, chaired by Frédéric Gardès, met on November 15, 2022 to approve the financial statements at September 30, 2022 and outlook for the current year.

Consolidated key figures

Order backlog

The order backlog at the end of September 2022 stood very high at €12.4 billion, up 19% year-on-year at constant exchange rates and excluding major acquisitions and disposals.

In Mainland France, the order backlog was up 5% year-on-year, at €3.2 billion, mainly in the Roads business, which grew 7%.

Order backlog for the Group’s International and French Overseas units was up 25%, totaling €9.2 billion at constant exchange rates and excluding major acquisitions and disposals. During Q3, Colas secured major road contracts in the United States as well as the extension project for the Birmingham tramway for €192 million at Colas Rail in the United Kingdom.

International and French Overseas units account for 74% of Colas' total order backlog, compared to 68% at the end of September 2021.

Revenue

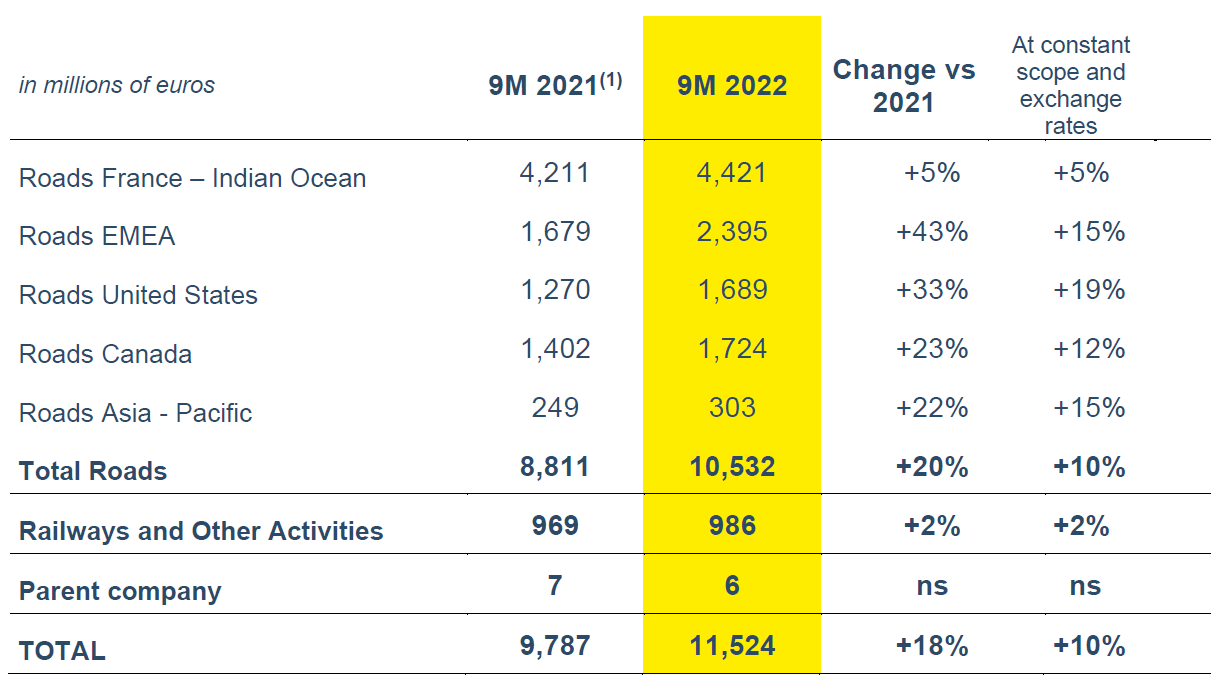

Consolidated revenue at September 30, 2022 amounted to €11.5 billion, up 18% compared to September 30, 2021 (+10% at constant scope and exchange rates). Revenue totaled €4.6 billion in France (+4% at constant scope) and €6.9 billion in the international units (+30% and +14% at constant scope and exchange rates).

Business during the 3rd quarter was up 19% compared to end-September 2021 (+10% at constant scope and exchange rates).

Roads :

Revenue for the Roads segment amounted to €10.5 billion at September 30, 2022, up 10% at constant scope and exchange rates year-on-year:

- Business in the France-Indian Ocean zone is up 5% compared with end-September 2021.

- Business in the EMEA1 zone is up a sharp 15% on at constant scope and exchange rates year-on-year. In addition to higher prices, Colas companies benefited from the ramp-up of major projects in Europe and Africa. The contribution of Destia stood at €430 million for the first nine months.

- In the United States, revenue grew a sharp 19% at constant scope and exchange rates year-on-year.

- In Canada, business increased 12% at constant scope and exchange rates year-on-year, largely due to the increase in prices of bitumen marketed by McAsphalt.

- Lastly, in the Asia-Pacific zone, revenue rose 15% at constant scope and exchange rates.

Railways and Other Activities :

Revenue from the Railways and Other Activities was up a slight 2% compared to the end of September 2021, boosted in particular by good momentum at Colas Rail's business outside of France.

Financial performance

Current operating profit at September 30, 2022 amounted to €213 million, down €20 million compared to September 30, 2021. The current operating margin totaled 1.8%, down 0.6 points compared with the end of September 2021.

In the third quarter of 2022, current operating profit amounted to €373 million, up €40 million from Q3 2021, boosted by the first impact of price increase policies.

The share of income from joint ventures and associated entities amounted to €32 million, up €21 million compared to end-September 2021. At €11 million, Tipco Asphalt's contribution was down €3 million compared to end-September 2021.

Net profit attributable to the Group stood at €139 million, compared with €127 million at the end of September 2021.

Net debt

Net debt at September 30, 2022 amounted to €1,384 million, compared to net debt of €443 million at the end of September 2021. The change is mainly due to:

- a decrease in free cash flow of €116 million compared to end-September 2021;

- higher working capital requirements, in the wake of increased inventory values (in particular bitumen inventories) and trade receivables, which is linked to a strong increase in revenue;

- payment of dividends for €227 million in May 2022, compared to €97 million in May 2021.

CSR commitments

The European Sustainable Development Week was held from September 18 to October 8 across the entire Colas Group network. The event highlights the challenges of sustainable development to raise awareness and encourage concrete action at all levels, both individual and collective, by promoting social responsibility initiatives launched by organizations and companies.

The program was broken down into three key moments: understanding, discovering and acting, to highlight Colas’ 8 CSR commitments set out within the Act Project launched in 2021.

The commitments provide the building blocks to make CSR an integral part of the Group's businesses, manage the impacts and risks of Colas’ activities (low-carbon strategy and biodiversity, circular economy, acceptability), ensure managerial excellence to attract, develop and retain talent, consolidate a health and safety culture, as well as build a responsible value chain and an exemplary ethical and compliance culture.

CSR initiatives have been carried out around the world, such as the climate fresco, a groupwide CSR contest, open house events and local solidarity projects.

Governance

The Board has taken note of the resignation of Mr. Arnauld Van Eeckhout, effective October 17, 2022, from his position as Director, member of the Selection and Compensation Committee and member and Chairman of the Ethics and Corporate Patronage Committee.

Consequently, and on the proposal of the Selection and Compensation Committee, the Board has decided to co-opt Mr. Didier Casas as a Director for the remainder of Mr. Arnauld Van Eeckhout’s term of office, i.e., until the General Shareholders’ Meeting to be held in 2024 to approve the 2023 financial statements. Mr. Didier Casas’ co-option will be put forward to the next General Shareholders’ Meeting for approval.

Mr. Didier Casas will also be a member of the Selection and Compensation Committee and a member and Chairman of the Ethics and Corporate Patronage Committee.

Outlook

The Colas Group, which does not operate in Russia or Ukraine, is not directly impacted by the current military conflict. The Colas Group is nonetheless paying very close attention to global macro-economic trends and any direct or indirect impact they might have on business and results.

Revenue in 2022 will be significantly higher than in 2021, boosted by the contribution of Destia, higher unit prices for products and services sold by the Group against a very inflationary economic background, and an exchange rate effect caused by Euro to US dollar variations. In a complex environment like this, the Group has put in place action plans to offset the impact of cost increases and safeguard its financial performance. The Colas Group expects its 2022 current operating profit to be higher than in 2021.

Given the inflationary environment, particularly in countries bordering Ukraine, and its dilutive impact on the current operating margin, especially in the bitumen trading business, it is no longer relevant to set profitability targets for 2023 in terms of the current operating margin rate. For this reason, the Colas Group is replacing its target of a 4% current operating margin in 2023 with a target for an increase in 2023 current operating profit compared to 2022. Nonetheless, thanks to buoyant fundamentals and the positive impact of a series of transformation projects that have been undertaken, the Colas Group is confident in its ability to reach, going forward, the current operating margin rate target it set.

Condensed consolidated income statement for Q3 2022

Revenue at September 30, 2022 by business segment

Glossary

Order backlog: the amount of work still to be done on projects for which a firm order has been taken, i.e., the contract has been signed and has taken effect (after notice to proceed has been issued and suspensory clauses have been lifted).

Changes in revenue at constant scope and exchange rates:

- at constant exchange rates: change after translating foreign-currency sales for the current period at the exchange rates for the comparative period;

- at constant scope: change in revenue for the periods compared, adjusted as follows:

- for acquisitions, by deducting from the current period those sales of the acquired entity that have no equivalent during the comparative period;

- for divestments, by deducting from the comparative period those sales of the divested entity that have no equivalent during the current period.

Free Cash Flow: Net cash flow (determined after (i) cost of net debt, (ii) interest expense on lease obligations and (iii) income taxes paid), minus net capital expenditure and repayments of lease obligations. It is calculated before changes in WCR (working capital requirement).

Net surplus cash/(Net debt): the aggregate of cash and cash equivalents, overdrafts and short-term bank borrowings, non-current and current debt, and financial instruments. Net surplus cash/(Net debt) does not include non-current and current lease obligations. A positive figure represents net surplus cash and a negative figure represents net debt.

Discover Colas’ latest press releases

Colas strengthens its operations in France with the acquisition of the Burgundy-based Hubert Rougeot Meursault Group

Appointment Stéphanie Minnebois, Group VP Techniques, Research, Development and Innovation, joins Colas' Executive Committee