Half-year results 2022

- Order backlog is at a record high of €12.9 billion, up 25% year-on-year (+14% at constant exchange rates, excluding main acquisitions and disposals)

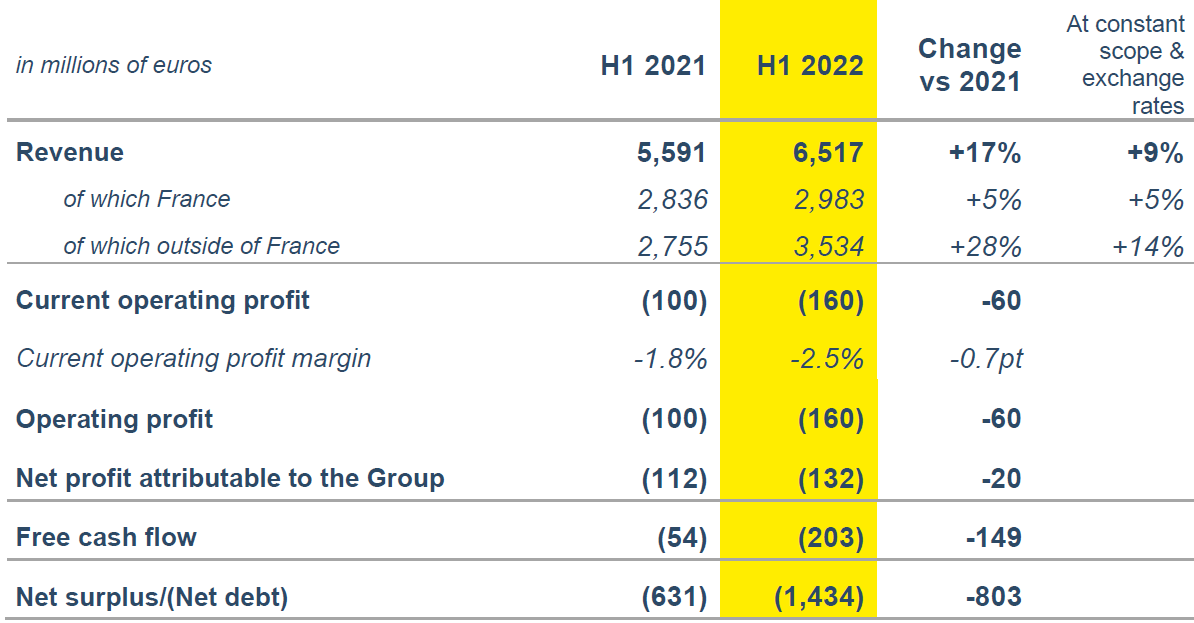

- Revenue totaled €6.5 billion, up 17% from H1 2021 (+9% at constant scope and exchange rates)

Reminder: due to highly seasonal nature of the majority of the Group's businesses, operating losses are recorded every first half-year.

- Current operating profit was at -€160 million, down €60 million compared to H1 2021

- Net profit attributable to the Group amounted to -€132 million, down €20 million compared to H1 2021

- Free cash flow totaled -€203 million, down €149 million compared to H1 2021

- Net debt was at €1.4 billion, up €0.8 billion compared to the end of June 2021

The Board of Directors of Colas, chaired by Frédéric Gardès, met on July 28, 2022 to approve the financial statements as at June 30, 2022 and the outlook for the current year.

Consolidated key figures

Order backlog

The order book at the end of June 2022 stood at a record high of €12.9 billion, up 25% year-on-year and up 14% at constant exchange rates, excluding main acquisitions and disposals.

In mainland France, the order backlog amounts to €3.4 billion, stable year-on-year. The Roads segment’s healthy backlog has offset a drop in the Railway segment’s backlog.

For the International and French Overseas units, order backlog totals €9.5 billion, a sharp 37% year-on-year increase (+20% at constant exchange rates, excluding major acquisitions and disposals). The increase is mainly attributable to:

- the addition at end-2021 of Destia’s order backlog;

- Colas Rail's international order backlog, with the Manila metro contract awarded in December 2021 and, in the United Kigdom, the five-year extension of the Alliance Contract with Network Rail for the renewal and modernization of rail infrastructure in the south of the country, recorded in June 2022;

- a good order backlog in North America, boosted by major road upgrading contracts in the United States and maintenance contracts in Canada.

International and Overseas France units account for 74% of Colas' total order backlog, compared to 67% at the end of June 2021.

Revenue

Consolidated revenue for the first half of 2022 stood at €6.5 billion, up 17% compared to the first half of 2021 (+9% at constant scope and exchange rates).

A breakdown of H1 2022 revenue shows that France accounted for €3.0 billion (+5% year-on-year) and the international units for €3.5 billion (+28% and +14% at constant scope and exchange rates).

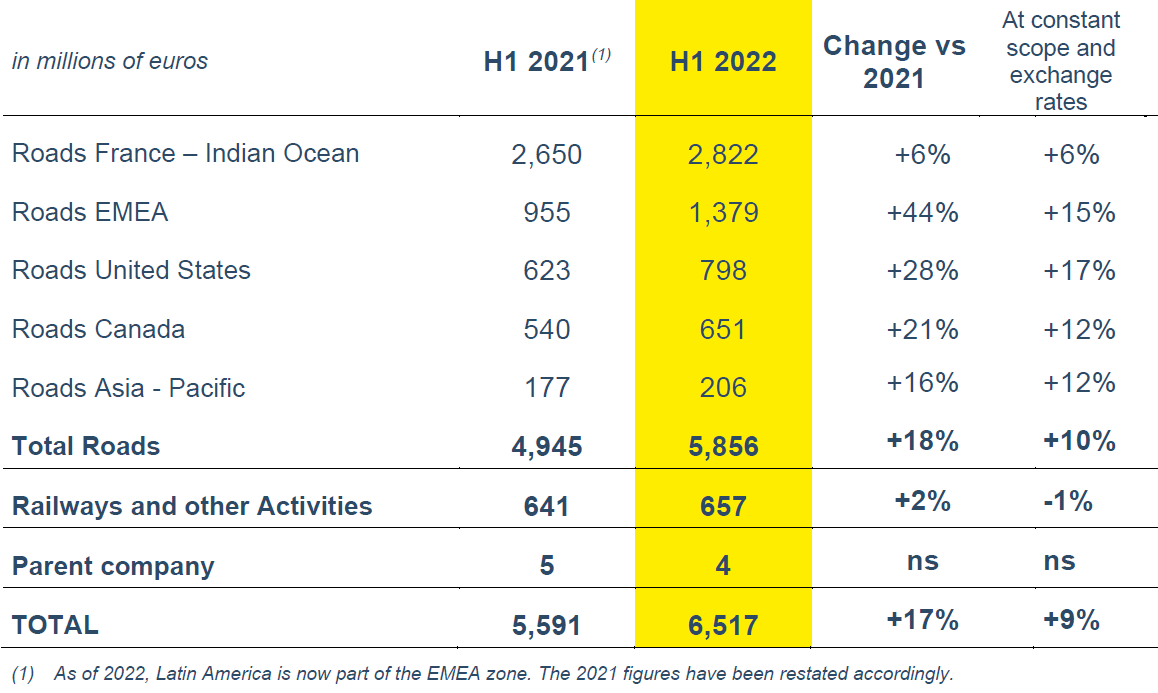

Roads:

Revenue for the first half of 2022 totaled €5.9 billion, up 10% at constant scope and exchange rates. In most countries, Colas companies have taken all possible steps to pass on the sharp rise in production costs (bitumen, energy, labor, etc.) in the unit prices of their products and services. The price increases have had significant impact on the increase in revenue.

- Revenue in the France-Indian Ocean region is up 6% compared to the first half of 2021.

- Revenue in the EMEA1 region (Europe, Middle East, Africa) is up 15% at constant scope and exchange rates. In addition to higher prices, the geography benefited from the ramp-up of major projects in Europe and Africa. Destia contributed approximately €250 million for the first half.

- In the United States, revenue rose sharply by 17% at constant scope and exchange rates.

- In Canada, revenue increased by 12% at constant scope and exchange rates, mainly due to the increase in the price of bitumen marketed by McAsphalt.

- Finally, in the Asia-Pacific region, revenue is up 12% at constant consolidation scope and exchange rates.

Railways and other Activities:

For Railways and other Activities, revenue is up 2% year-on-year, mainly boosted by good momentum in Colas Rail's international business.

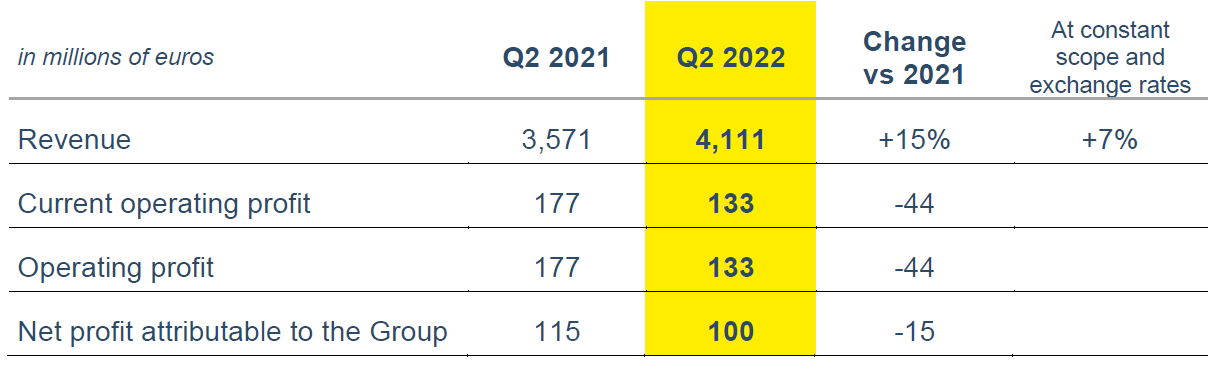

Financial performance

Current operating profit for the first half of 2022 amounted to -€160 million, down €60 million compared to the first half of 2021. As a reminder, the first half of 2021 was less impacted by the seasonal nature of Colas’ businesses, due in particular to better weather in Canada. The sharp increase in production costs, particularly energy and bitumen during the first half of 2022, broadly penalized profitability for contracts that were recorded in the order backlog prior to the sudden price hikes. In fact, the increases were not able to be systematically passed on to clients, as some of the contracts did not provide for price adjustments, be they total or partial, and others were based on price indexes that only partially reflect the real increase in costs.

The Group's share of net income from joint ventures and associates amounted to €22 million, up €18 million compared to the first half of 2021. Tipco Asphalt's contribution of €8 million was down €2 million, compared to the end of June 2021.

Net profit attributable to the Group stood at -€132 million, compared with -€112 million at the end of June 2021.

Net debt

Net debt at June 30, 2022 stood at €1.4 billion, compared with net debt of €0.6 billion at the end of June 2021. The change is mainly attributable to:

- a €149-million decrease in free cash flow compared to the end of June 2021, in line with the decrease in results;

- a deterioration in working capital requirements, due to the increase in the value of inventories (in particular bitumen) and the increase in trade receivables linked to the sharp rise in revenues;

- payout of dividends for €227 million in May 2022, compared to €97 million in May 2021.

Corporate Social Responsibility

On May 24 and 25, 2022, nearly 700 Colas managers gathered at the Colas in Motion Convention, an event dedicated to Corporate Social Responsibility (CSR) and the Group’s ACT corporate project (Act and Commit Together).

Be it in terms of safety, the environment, managerial excellence or business ethics, Colas is preparing to face the challenges of today and tomorrow with CSR. Fostering cross-functionality, gaining agility, improving coordination and communication on actions in a concrete, transparent manner, measuring progress... Each employee has a role to play in conveying the pioneering spirit of Colas and giving concrete expression to the Group’s eight CSR commitments.

A panel of Colas experts spoke about the impact of CSR on the Colas business model and on how the organization is transforming.

- External speakers gave presentations in plenary sessions and in the form of "masterclasses" on four themes (reconciling climate and economic activity, circular economy, inclusive leadership, renewable energies). The aim was to open up the participants' mindset and broaden their horizons.

- During the Convention, the "village" hosted detailed presentations of Colas' CSR-centric actions and initiatives.

- More than 600 managers participated in the "Climate Frescoes" awareness-raising workshop and 64 frescoes were completed.

“The bedrock of any successful corporate project is getting teams in the field mobilized and onboard! The managers who took part in the Colas in Motion Convention now have a key role to play: as ambassadors of the ACT project, they must convey the messages to their teams to ensure that the Group's CSR commitments are actually put into practice.” - explains Frédéric Gardès, Chairman & CEO.

Outlook

Colas, which does not operate in Russia or Ukraine, is not directly impacted by the current conflict. The Group is nonetheless paying very close attention to global macro-economic trends and any direct or indirect impact they might have on its businesses and its results.

Revenue in 2022 should be significantly higher than in 2021, due to the high order backlog to be completed in the second half of 2022, the contribution of Destia, rising unit prices for products and services sold by the Group in a highly inflationary environment, and foreign currency effects with a low euro against the US dollar.

Colas expects its 2022 current operating profit to be higher than in 2021. Part of the increase in revenue has an immediate dilutive impact on the current operating profit margin, in particular for the bitumen trading business. The Group has put in place action plans to offset the impact of rising costs and to safeguard its financial performance.

Condensed consolidated income statement for Q2 2022

Revenue at June 30, 2022 by business segment

Glossary

Order backlog: the amount of work still to be done on projects for which a firm order has been taken, i.e., the contract has been signed and has taken effect (after notice to proceed has been issued and suspensory clauses have been lifted).

Changes in revenue at constant scope and exchange rates:

- at constant exchange rates: change after translating foreign-currency sales for the current period at the exchange rates for the comparative period;

- at constant scope: change in revenue for the periods compared, adjusted as follows:

- for acquisitions, by deducting from the current period those sales of the acquired entity that have no equivalent during the comparative period;

- for divestments, by deducting from the comparative period those sales of the divested entity that have no equivalent during the current period.

Free Cash Flow: Net cash flow (determined after (i) cost of net debt, (ii) interest expense on lease obligations and (iii) income taxes paid), minus net capital expenditure and repayments of lease obligations. It is calculated before changes in WCR (working capital requirement).

Net surplus cash/(Net debt): the aggregate of cash and cash equivalents, overdrafts and short-term bank borrowings, non-current and current debt, and financial instruments. Net surplus cash/(Net debt) does not include non-current and current lease obligations. A positive figure represents net surplus cash and a negative figure represents net debt.

Discover Colas’ latest press releases

Colas strengthens its operations in France with the acquisition of the Burgundy-based Hubert Rougeot Meursault Group

Appointment Stéphanie Minnebois, Group VP Techniques, Research, Development and Innovation, joins Colas' Executive Committee