Half Year 2016

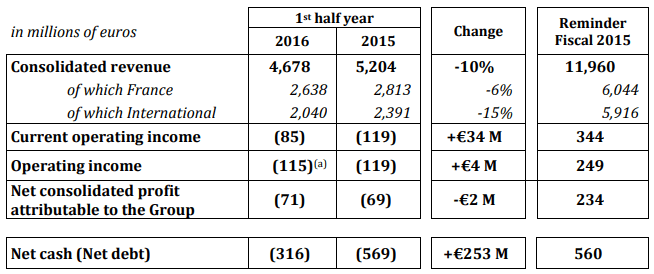

- Revenue: €4.7 billion euros (-10% and -6% at constant scope and exchange rates) [Heavily impacted by changes in scope pertaining to the sale and cessation of bitumen activities in Asia and in France (-€179 million), and by currency effects (-€60 million)]

- Improved current operating income (+€34 million) and current operating profit margin (+0.5 pt)

- Stability of net profit attributable to the Group: -€71 million (compared to -€69 million on June 30, 2015) • High level of work on hand: €8.0 billion (stable and +3% at constant exchange rates)

The Board of Directors of Colas, chaired by Mr. Hervé Le Bouc, met on August 29, 2016 to assess the position for the first half year ended June 30, 2016 and outlook for the full year.

Consolidated key figures

(a) As of end-June 2016, 30 million euros were accounted for in non-current expenses pertaining to the refined product activity that is being closed (fixed charges and adjustments of charges for the social plan currently underway).

Reminder: seasonal nature of business at Colas

Given the highly seasonal nature of the majority of Colas’ businesses, it is important to underline the fact that the Group’s half-year results are not representative of its full-year performance.

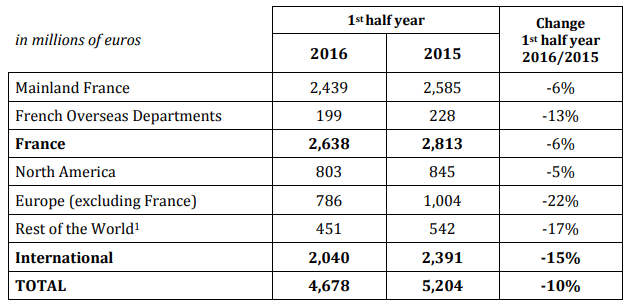

First half year 2016 revenue is down 10%

Revenue for the first half 2016 totaled 4.7 billion euros, down 10% compared to June 30, 2015 (-6% at constant scope and exchange rates). The 15% drop in the international units is attributable in part to strong changes in scope of consolidation (-179 million euros) and currency effect (-60 million euros). The changes in scope mainly pertain to the sale of bitumen storage and trade activities in Asia to the Thai subsidiary Tasco, in which Colas holds a 32% share, and to the cessation of the refining business in France.

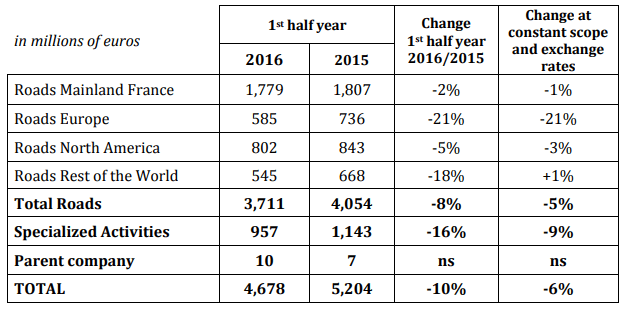

Roads:

During the first half year, the road business posted revenue of 3.7 billion euros, down 8% from June 30, 2015:

- in Mainland France, revenue is similar to the first half year 2015 despite disruptions in May and June (supply issues for bitumen and oil products due to strikes and poor weather). The market seems to be stabilizing at a level near that of 2015, after a sharp two-year slump;

- in North America, revenue is down slightly (-3% at constant scope and exchange rates), with business starting up roughly one month later than usual in Canada;

- in Europe, revenue is down 21%. Business in northern Europe is similar to the first half year 2015 at constant exchange rates, whereas revenue in central Europe recorded a sharp drop due to a forecast delay in the launching of major road construction bids, in particular in Hungary and Slovakia, which started as of July;

- in the Rest of the World (international excluding Europe and North America), revenue appears to have taken a sharp decline (-18%) but is identical to first half 2015 at constant scope and exchange rates (+1%). The gap is due to the sale of subsidiaries in Asia to the Thai subsidiary Tasco, consolidated by the equity method.

Specialized Activities:

Revenue in Specialized Activities was down 16% and 9% at constant scope and exchange rates (cessation of the refined products activity and depreciation of the pound against the euro). Most of this 9% decrease at end-June 2016 was due to:

- the Railway sector, whose business is spread out differently over the year compared to 2015, a gap that should be made up for during the second half year;

- a 10% drop in Waterproofing.

Profitability

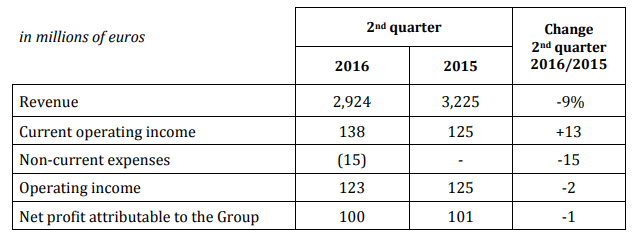

As of June 30, 2016, current operating income amounted to -85 million euros, compared to -119 million euros on June 30, 2015, a 34-million euro improvement.

Operating income from the Roads business is identical to end-June 2015 despite an 8% drop in revenue. Operating profit margin has improved thanks to adaptation plans. Operating income for Specialized Activities is down by 9 million euros due to the fact that activity in the Railway sector has slid over to the second half year 2016.

Fixed charges pertaining to the refining unit in Dunkirk that is currently being closed, as well as additional costs for the social plan approved in May 2016, have led to 30 million euros in non-current expenses at end-June 2016.

Income from associates and joint ventures totaled 31 million euros, compared to 30 million euros at end-June 2015.

Colas’ net profit at the end of June is traditionally negative due to the seasonal nature of its businesses. Net profit attributable to the Group at the end of June 2016 amounted to -71 million euros, compared to -69 million euros at end-June 2015.

Net debt

On June 30, 2016, net debt amounted to 316 million euros, compared to 569 million euros end-June 2015. The change from December 31, 2015 (net cash at 560 million euros) reflects the seasonal nature of Colas’ businesses.

Work on hand

Work on hand remains high at the end of June 2016 for a total of 8.0 billion euros, almost identical to end-June 2015 (-0.8%). It is up 3% at constant exchange rates. Work-on-hand in the international units and French Overseas departments is identical to end-June 2015 and work-on-hand in Mainland France is down 1.7%.

Outlook

On the basis of currently available information, revenue at constant scope and exchange rates could decrease by roughly 2% in 2016. Forecasts show improvement in profitability.

Consolidated summary income statement for second quarter 2016

First half year 2016 revenue by operating sector

First half year 2016 revenue by geographic zone

1 including French Overseas Territories

Discover Colas’ latest press releases

Colas strengthens its operations in France with the acquisition of the Burgundy-based Hubert Rougeot Meursault Group

Appointment Stéphanie Minnebois, Group VP Techniques, Research, Development and Innovation, joins Colas' Executive Committee