Fiscal Year 2021

- Acquisition of Destia for €222 million on December 1, 2021, providing an additional €755 million to order backlog

- Order backlog at a record €10.7 billion, up 17% year-on-year, or +9% at constant exchange rates, and excluding major acquisitions and disposals

- Revenue at €13.2 billion, up 7% vs. 2020 at constant scope and exchange rates

- Current operating margin at 3.3%, slightly higher than in 2019

- Free cash flow at €358 million remains high

- Net debt close to zero, virtually stable over the year, including Destia

- Confirmation of target current operating margin at 4% in 2023

The Board of Directors of Colas, chaired by Mr. Frédéric Gardès, met on February 22, 2022 to finalize the 2021 financial statements that are to be presented to the Annual General Shareholders’ Meeting on April 26, 2022.

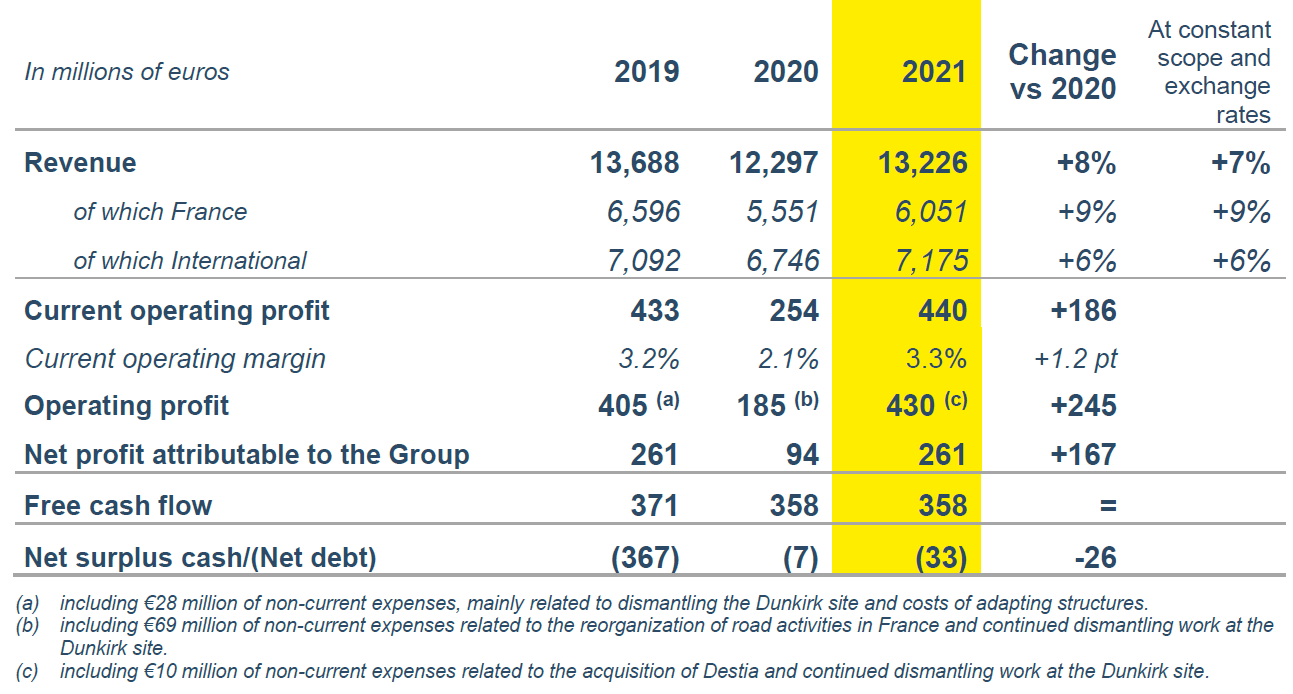

Consolidated key figures

Order backlog

The order backlog at the end of December 2021 totaled a record €10.7 billion, up 17%, and +9% at constant exchange rates, excluding major acquisitions and disposals over the year. These figures include the order backlog of Destia in Finland for €755 million.

In mainland France, the order backlog came in at €3.0 billion, down 3% year-on-year, in particular for the Railways segment, whereas the order backlog for the Roads segment was up 3%.

The order backlog for the International and Overseas France units totaled €7.7 billion, up 28% year-on-year (i.e., 14% at constant exchange rates, excluding major acquisitions and disposals). The year 2021 was marked in particular by good business momentum in Canada, where Miller won seven major contracts worth a total of nearly €300 million, and by the integration of Destia’s order backlog.

In the fourth quarter, Colas signed an 8-year motorway maintenance and response contract on Area 9 in the United Kingdom for €400 million (with some €160 million in the order backlog). Colas Rail also secured a major turnkey contract to design and build the first underground line of the Manila metro in the Philippines for €760 million (with €680 million in the order backlog).

The International and Overseas France units account for 72% of the total order backlog for Colas, compared to 66% at end-December 2020.

Revenue

Consolidated revenue at December 31, 2021 amounted to €13.2 billion, up 8% compared to December 31, 2020. France accounted for €6.0 billion in revenue (+9%), and the international units for €7.2 billion (+6% at constant scope and exchange rates).

Roads:

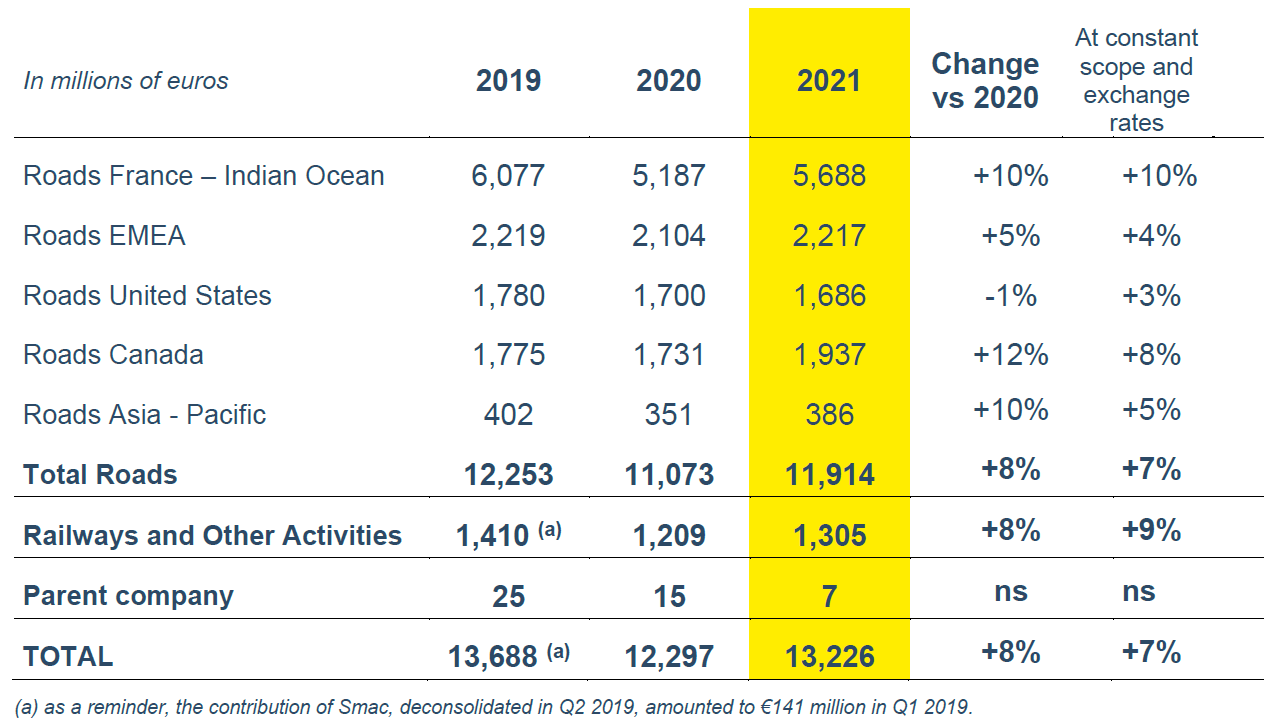

Revenue for the Roads segment amounted to €11.9 billion at December 31, 2021, up 7% year-on-year at constant scope and exchange rates:

- Business in the France-Indian Ocean zone improved by 10% compared to the end of December 2020, benefiting from a favorable comparison base with 2020 in the wake of Covid-related lockdowns. In mainland France, business was down 7% compared with the end of December 2019, reflecting a decline in public procurement projects in a post-election period.

- Revenue in EMEA (Europe, Middle East, Africa) improved by 4% year-on-year at constant scope and exchange rates, boosted by business in Europe.

- In the United States, revenue was up 3% at constant scope and exchange rates over the year.

- In Canada, revenue grew 8% year-on-year at constant scope and exchange rates. Business benefited from favorable operating conditions and good momentum in most provinces, particularly in Ontario for Miller.

- Lastly, in the Asia-Pacific zone, revenue rose 5% at constant scope and exchange rates over the year.

Railways and Other Activities:

Revenue from Railways and Other Activities was up 8% compared to the end of December 2020 (+9% at constant scope and exchange rates). The increase in Colas Rail's revenue was boosted by the good performance of its businesses in France and the United Kingdom.

Financial performance

Current operating profit at the end of December 2021 amounted to €440 million, up €186 million on 2020 and €7 million on 2019. The current operating margin was 3.3%, up a slight 0.1 point compared to the end of December 2019. This improvement is the result of good performance of the Group’s businesses in Canada, the initial impact of optimization plans for industrial activities, as well as the new organization at Colas France.

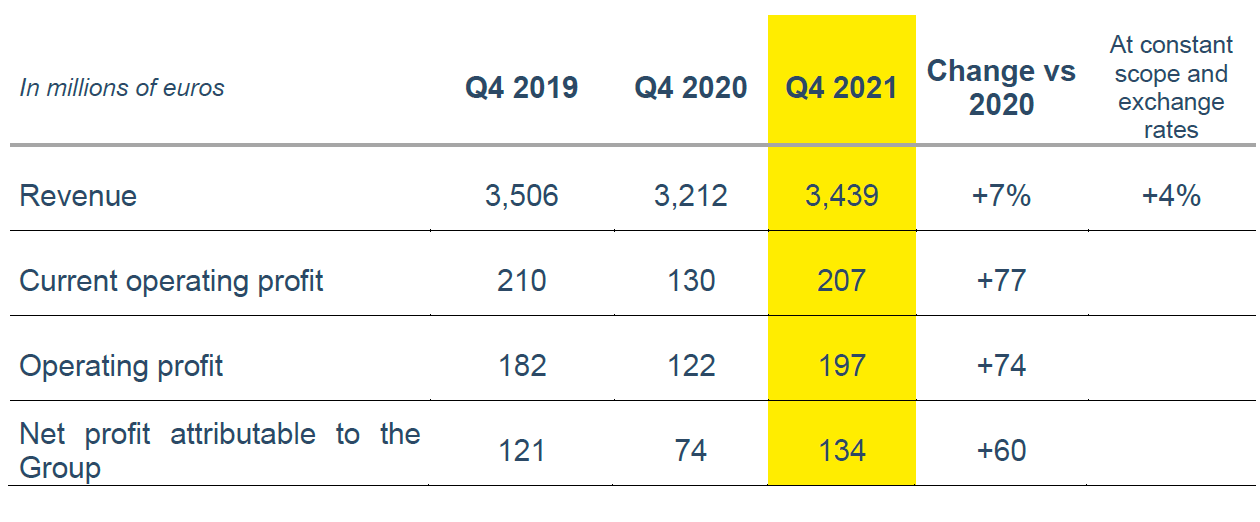

In the fourth quarter of 2021, current operating profit amounted to €207 million, representing a 6.0% current operating margin, stable compared to Q4 2019.

Non-recurring operating expenses at the end of December 2021 amounted to €10 million and were related to the acquisition of Destia and ongoing dismantling work at the Dunkirk site.

Operating profit therefore amounts to €430 million, compared with €185 million in 2020 and €405 million in 2019.

The Group's share of income from joint ventures and associates totaled €22 million, down €16 million compared with the end of December 2020. Tipco Asphalt's contribution at €20 million is down €10 million compared to 2020, in the wake of impact from the health crisis in Asia and less favorable market conditions.

Lastly, net profit attributable to the Group totaled €261 million, compared to €94 million at the end of December 2020, and €261 million at the end of December 2019.

Net debt

In 2021, Colas kept its net debt close to zero (€33 million, compared to €7 million at the end of December 2020).

- Free cash flow remained stable at €358 million, with improvement in profits offset by a controlled return to gross operating investments, which increased by €53 million at €357 million. Disposals were virtually unchanged year-on-year at €123 million.

- Changes in working capital requirements amounted to -€140 million, compared to +€313 million at the end of December 2020. As a reminder, this figure reflected the sharp pandemic-related drop in business activity.

- Cash flows from investment activities amounted to €170 million, up €129 million compared to the end of December 2020, including the acquisition of Destia for €222 million (excluding acquisition costs).

- Lastly, dividends paid out in 2021 totaled €96 million, compared to €212 million in 2020. Shareholders' equity amounted to €3.0 billion at December 31, 2021 compared to €2.6 billion at December 31, 2020.

Shareholders' equity amounted to €3.0 billion at December 31, 2021 compared to €2.6 billion at December 31, 2020.

Dividend

The Board of Directors will propose to the Annual General Meeting to be held on April 26, 2022 to distribute a dividend of €6.85 per share, compared to €2.90 last year.

Perspectives

Revenue in 2022 should be significantly higher than in 2021, notably due to the contribution of Destia.

In the wake of a buoyant recovery in business in 2021, Colas is continuing to focus on programs aiming to improve profitability, and confirms its objective of 4% current operating margin in 2023.

Governance

The Board has taken note of the resignation of Mr. Olivier Bouygues from his position as Director with effect as of the end of the Board Meeting on February 22, 2022.

Consequently, and on the recommendation of the Selection and Compensation Committee, the Board has decided to co-opt Cyril Bouygues as a Director for the remainder of Olivier Bouygues' term, i.e., until the close of the Shareholders' Meeting to be held in 2023 to approve the financial statements for fiscal year

2022. This decision will be submitted for approval to the General Shareholders' Meeting on April 26, 2022.

In addition, as the directors’ terms of Ms. Catherine Ronge and Mr. Arnauld Van Eeckhout are due to expire, the Board of Directors will ask the General Shareholders’ Meeting on April 26, 2022 to renew their terms for a further two years, i.e., until the end of the 2024 General Shareholders’ Meeting to approve the financial statements for the year ending December 31, 2023.

Climate Strategy Update

At the end of 2020, Colas announced its objectives to reduce its direct greenhouse gas emissions (scopes 1 and 2) by 30% and its indirect upstream emissions (scope 3a) by 30% by 2030, compared to the reference year 2019. These targets, which are compatible with the Paris Agreement, have been validated by the Science Based Targets (SBTi) initiative.

To achieve these targets, and as part of its climate strategy, Colas rolled out a low-carbon and biodiversity roadmap across all its operating units worldwide in 2021. To carry out its climate strategy, Colas has earmarked for 2022-2024 an estimated €245 million1 to help reduce its carbon footprint.

To raise employee awareness of the challenges of climate change, a dedicated Climate day was organized on April 8, 2021 in all Colas entities, and training courses were provided, such as the "Climate Fresco" session in which more than 950 Group employees took part.

Actions have been carried out based on the six paths for progress of the Group's low-carbon and biodiversity roadmap:

- Path 1 - Integrating climate change issues into Group strategy

- Activity in the Renewable Energies business line has been boosted (wind farms, etc.).

- Colas Rail has developed patented "green lanes" in towns and cities, which help adapt to climate change by limiting impervious surfaces in urban environments, and has applied it on the Angers tramway and the Greater Paris T13 tramway projects.

- Path 2 - Implementing actions to reduce the carbon intensity of direct emissions (scopes 1 and 2)

- Colas has begun to convert its fleet of passenger vehicles to all-electric. To this end, Colas has begun installing charging stations for electric vehicles in all of its 300 profit centers in France, with the aim of making combustion engine vehicles an exception in three years’ time. This approach will be extended across the Group’s worldwide map in the coming months.

- In France, Colas has signed an agreement with Saipol (Avril Group) to power its fleet of trucks with Oleo100, a renewable "B100" bio fuel, which reduces greenhouse gas emissions by 60% compared to diesel fuel and cuts fine particle emissions by up to 80%.

- Colas France has also signed renewable electricity contracts with its main suppliers, incorporating guarantees that the electricity it consumes was produced in France for 2021, 2022 and 2023. A similar approach has been taken in the United Kingdom.

- Colas Rail's patented Ecostop innovation for locomotives, similar to Start & Stop in the automotive sector, has been awarded an Energy Savings Certificate (CEE) by the French Ministry of Ecological Transition.

- Path 3 - Developing and promoting low-carbon techniques and solutions

- In 2021, a subsidiary was created in France, called Tersen, combining the extraction and materials recovery businesses, as well as waste management in the construction sector for the Greater Paris Area. This is an important step in developing circular economy activities.

- Having a greater focus on materials recovery has resulted in the recycling of more than 8.5 million tons of materials, an increase of 9% compared to 2020.

- The reclaimed asphalt pavement (RAP) content reached an average of 16% in 2021.

- Some 8 million m² of pavement was retreated in place in 2021, an increase up 16% compared to 2019.

- In order to support customers in the low-carbon transition, nearly 200 eco-alternatives were offered, twice as many as in 2020.

- Several pilot projects are underway to develop biobased binders to reduce the carbon footprint of asphalt mixes (Vegecol).

- Path 4 - Implement carbon accounting and reduce indirect emissions from upstream activities (scope 3a)

- Tools to calculate the carbon footprint of projects and products are currently being deployed.

- In December 2021, Colas Rail organized its first "Carbon Fighter" forum, bringing together suppliers and other partners in the rail industry to exchange best practices and initiate a common roadmap for reducing the carbon footprint.

- Path 5 - Contributing to carbon neutrality and reducing emissions from customers and users

- Colas has signed a framework contract with the Société de livraison des ouvrages olympiques (Solideo), in anticipation of the 2024 Paris Olympic Games, to set up a service to regulate "last mile" logistics flows in the Paris region using the Qievo solution, thereby limiting the impact on the quality of life of local residents and on the environment.

- Path 6 - Integrate biodiversity preservation issues into operations

- Actions to promote biodiversity in quarries have increased, with more than 35 additional sites committed to the approach by 2021, bringing the number of committed sites to 207.

Colas continued to develop its expertise in ecological engineering in France, notably with the Ondaine river renaturation project in La Ricamarie, a project combining the uncovering of streams, soil decontamination, the management of invasive exotic plants, the installation of a fish pass, as well as the building of leisure facilities, and soft mobility infrastructure.

- Colas signed two partnerships to train young schoolchildren in biodiversity issues and to plant 22,000 trees in France and Côte d'Ivoire as part of the Forest & Life educational program.

Consolidated 4th quarter condensed income statement 2021

Revenue at December 31, 2021 by business segment

Glossary

Order backlog: the amount of work still to be done on projects for which a firm order has been taken, i.e., the contract has been signed and has taken effect (after notice to proceed has been issued and suspensory clauses have been lifted).

Changes in revenue at constant scope and exchange rates:

- at constant exchange rates: change after translating foreign-currency sales for the current period at the exchange rates for the comparative period;

- at constant scope: change in revenue for the periods compared, adjusted as follows:

- for acquisitions, by deducting from the current period those sales of the acquired entity that have no equivalent during the comparative period;

- for divestments, by deducting from the comparative period those sales of the divested entity that have no equivalent during the current period.

Free Cash Flow: Net cash flow (determined after (i) cost of net debt, (ii) interest expense on lease obligations and (iii) income taxes paid), minus net capital expenditure and repayments of lease obligations.

It is calculated before changes in WCR (working capital requirement).

Net surplus cash/(Net debt): the aggregate of cash and cash equivalents, overdrafts and short-term bank borrowings, non-current and current debt, and financial instruments. Net surplus cash/(Net debt) does not include non-current and current lease obligations. A positive figure represents net surplus cash and a negative figure represents net debt.

Discover Colas’ latest press releases

Colas strengthens its operations in France with the acquisition of the Burgundy-based Hubert Rougeot Meursault Group

Appointment Stéphanie Minnebois, Group VP Techniques, Research, Development and Innovation, joins Colas' Executive Committee