1st Quarter 2022 Results

- Order backlog at a record €12 billion, up 12% year-on-year at constant exchange rates and excluding major acquisitions and disposals

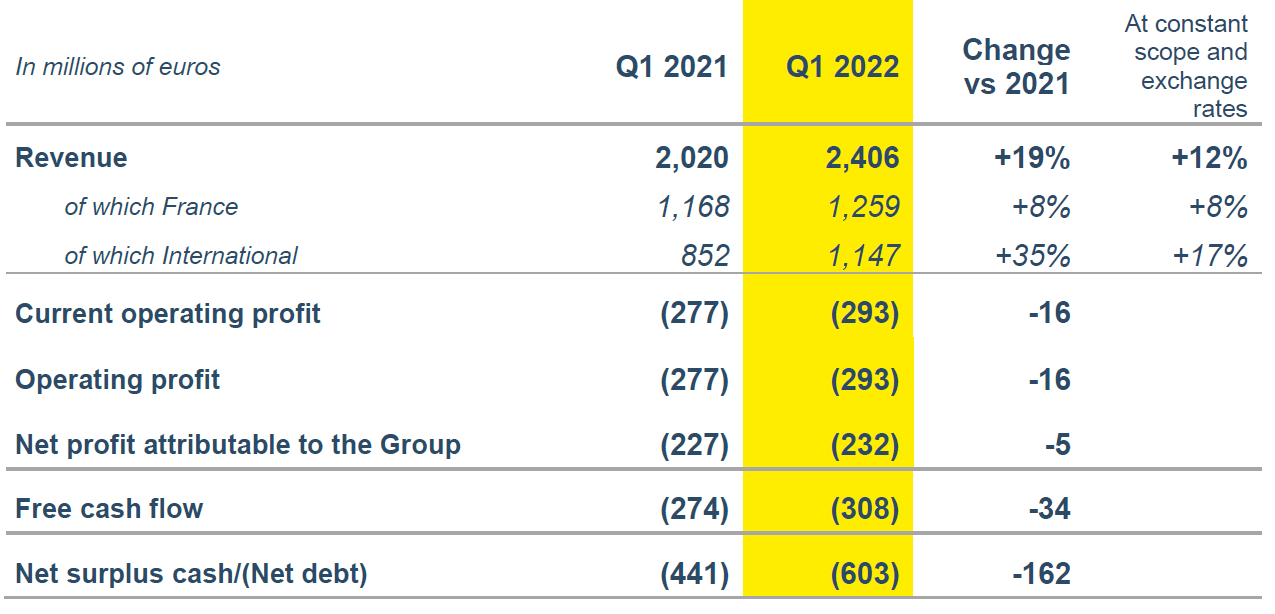

- Revenue at €2.4 billion, up 19% compared to Q1 2021 (+12% at constant scope & exchange rates)

Reminder: given the highly seasonal nature of its businesses, the Colas Group’s Q1 figures are not representative of its full year results.

- Current operating profit at -€293 million, down €16 million compared to Q1 2021

- Net profit attributable to the Group at -€232 million, down a slight €5 million compared to Q1 2021

- Free cash flow at -€308 million, down €34 million compared to Q1 2021

- Net debt at €603 million, up €162 million compared to end of March 2021

The Board of Directors of Colas, chaired by Mr. Frédéric Gardès, met on May 10, 2022 to review the accounts closed as of March 31, 2022 and outlook for the year.

Consolidated key figures

Order backlog

The order backlog at the end of March 2022 reached a record €12 billion, up 22% year-on-year and up 12% at constant exchange rates and excluding major acquisitions and disposals.

In Mainland France, the order backlog totaled €3.3 billion, up a slight 1% year-on-year.

In the International and French Overseas units, the order backlog amounted to €8.7 billion, up a sharp 33% year-on-year (18% at constant exchange rates and excluding major acquisitions and disposals), mainly driven by the addition of Destia’s order book for more than €700 million, by Colas Rail’s Manila

metro contract secured in Q4 2021, and by the Roads business in Canada and the United States.

In the first quarter of 2022, Colas Rail signed a contract for the construction of phase 1 of line 4 of the Cairo metro for €159 million. Colas also enjoyed buoyant sales in the United States and Canada.

The International and French Overseas units accounted for 72% of the order backlog, compared to 66% at end-March 2021.

Revenue

Consolidated revenue for the first quarter 2022 amounted to €2.4 billion, up a sharp 19% compared to the first quarter 2021 (+12% at constant scope and exchange rates). Revenue in France was up 8% at €1.3 billion. In the international units, revenue totaled €1.1 billion, up a sharp +35% (+17% at constant scope and exchange rates).

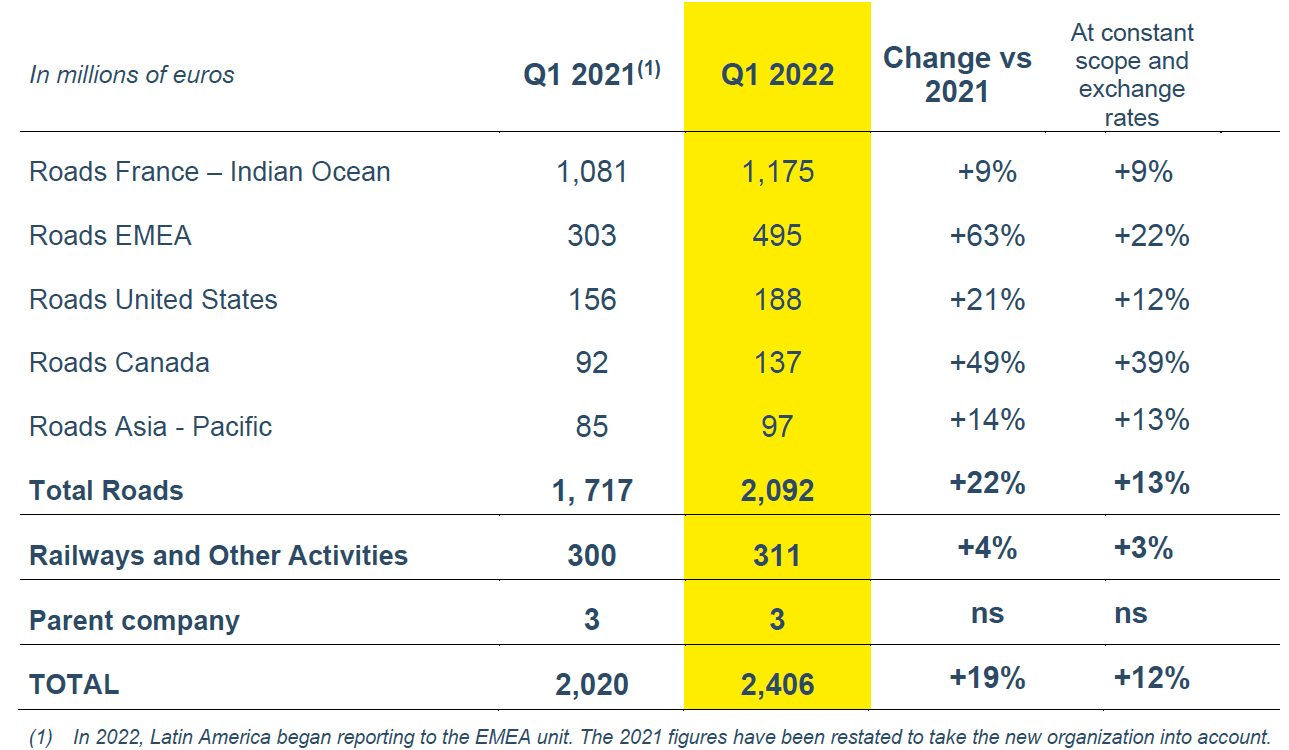

Roads

Revenue for the first quarter of 2022 amounted to €2.1 billion, up 22% (13% at constant scope and exchange rates) compared with Q1 2021.

- Benefiting from favorable weather conditions, revenue for France-Indian Ocean was up 9% year-on-year.

- Revenue in EMEA (Europe, Middle East, Africa)1 enjoyed a 22% increase at constant scope and exchange rates, boosted by a ramp-up on major projects. Destia contributed roughly €100 million in the quarter.

- In the United States, revenue was up 12% at constant scope and exchange rates.

- In Canada, revenue rose a sharp 39% at constant scope and exchange rates, mainly due to strong maintenance business at Miller and higher industrial volumes in Western Canada.

- Lastly, in the Asia-Pacific region, revenue was up 13% at constant scope and exchange rates.

Railways and Other Activities

Revenue from the Railways and Other Activities rose 4% year-on-year (+3% at constant scope and exchange rates), mainly due to international business at Colas Rail.

Financial performance

Current operating profit for Q1 2022 amounted to -€293 million, down €16 million compared with Q1 2021. This decrease is due in particular to the impact of unfavorable exchange rate due to the appreciation of US and Canadian dollars against the euro.

Income from joint ventures and associates totaled €7 million, up €9 million from Q1 2021. Tipco Asphalt's contribution of €1 million was down by €3 million year-on-year.

Net profit attributable to the Group amounted to -€232 million, compared with -€227 million in Q1 2021.

Net debt

Net debt at March 31, 2022 amounted to €603 million, compared to net debt of €441 million at end- December 2021.

CSR

At the end of January 2022, Colas joined the #StOpE initiative to combat so-called “ordinary" sexism in the workplace, thus reinforcing a multi-year commitment to the subject. Colas is the first company in the construction sector to sign on to the program.

As part of this initiative, two new tools have been rolled out: "Stop Gender Discrimination", a poster containing essential information that is distributed across the entire Colas network, and "Gender Discrimination: See it, Name it, Stop it”, a booklet that helps identify gender discrimination and what to do

if one is faced with unacceptable sexist behaviors within the company.

"Colas is committed to building a respectful workplace where all employees can thrive. We have zero tolerance for sexist or discriminatory behavior of any kind. We build inclusive work environments across our diverse geographies where everyone feels respected and valued for their contribution ", underlines

Frédéric Gardès, Chairman & CEO of Colas.

Outlook

Colas does not operate in Russia and Ukraine, and as such is not directly affected by the current conflict. The Group is monitoring the situation closely for any changes and indirect impacts. The outlook below does not include any significant further deterioration in the current macroeconomic and geopolitical

context.

Revenue in 2022 should be significantly higher than in 2021, in particular due to the contribution of Destia and price hikes for some raw materials.

After recovering well in 2021, Colas is continuing to work on improving profitability and confirms its objective of a 4% current operating margin in 2023.

Revenue at March 31, 2022 by business segment

Glossary

Order backlog: the amount of work still to be done on projects for which a firm order has been taken, i.e., the contract has been signed and has taken effect (after notice to proceed has been issued and suspensory clauses have been lifted).

Changes in revenue at constant scope and exchange rates:

- at constant exchange rates: change after translating foreign-currency sales for the current period at the exchange rates for the comparative period;

- at constant scope: change in revenue for the periods compared, adjusted as follows:

- for acquisitions, by deducting from the current period those sales of the acquired entity that have no equivalent during the comparative period;

- for divestments, by deducting from the comparative period those sales of the divested entity that have no equivalent during the current period.

Free Cash Flow: Net cash flow (determined after (i) cost of net debt, (ii) interest expense on lease obligations and (iii) income taxes paid), minus net capital expenditure and repayments of lease obligations. It is calculated before changes in WCR (working capital requirement).

Net surplus cash/(Net debt): the aggregate of cash and cash equivalents, overdrafts and short-term bank borrowings, non-current and current debt, and financial instruments. Net surplus cash/(Net debt) does not include non-current and current lease obligations. A positive figure represents net surplus cash and a negative figure represents net debt.

Discover Colas’ latest press releases

Colas strengthens its operations in France with the acquisition of the Burgundy-based Hubert Rougeot Meursault Group

Appointment Stéphanie Minnebois, Group VP Techniques, Research, Development and Innovation, joins Colas' Executive Committee